Auto insurance is quite important for American drivers since it provides financial protection should an accident or other event happen. Knowing the principles of auto insurance helps one to ensure drivers may make smart judgments about their coverage option. Auto insurance essentially covers costs associated with property damage, personal injury, and vehicle damage resulting from traffic accidents. If drivers are to maintain compliance and protect their assets, they must get acquainted with significant coverage forms and legal obligations.

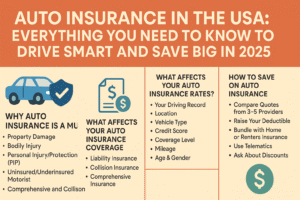

Usually mandated in most places, liability insurance is one of the primary coverage choices. This form of policy covers damages and injuries you could cause to other people in an accident. Usually divided into two, liability insurance pays for medical bills and lost wages of the wounded party while property damage liability covers repairs to the vehicles or property of others participating in the collision.

Apart from liability coverage, drivers could get collision insurance, which pays damages to their own car irrespective of who is at blame. On the other hand, careful coverage prevents non-collision incidents such theft, vandalism, or occurrence of natural disasters. Furthermore, uninsured motorist coverage is also important; it covers you should the at-fault driver have insufficient insurance to cover your costs.

Drivers should be informed of their specific regional regulations since state legal standards significantly affect each other. Although every state mandates a minimum level of liability coverage, more choices might provide more piece of mind. Knowing these fundamental principles will enable drivers negotiate the auto insurance terrain more deliberately, thereby ensuring they choose appropriate coverage customized to their needs and driving style.

How to Choose the Right Auto Insurance Policy

Choosing the right auto insurance package will help you mostly provide financial protection while driving. Given how much your driving record and location influence your insurance rates, your particular circumstances—including these factors—should be among the first ones you consider. Although a clean driving record could qualify you for lower premiums, past accidents or traffic offenses could result in greater charges. Moreover, where you live could influence rates depending on various risk assessments and legal environment.

Also greatly affects your vehicle insurance coverage the kind of car you drive. Although more reasonably priced, safer cars typically offer less coverage, pricey or high-performance cars typically attract higher premiums. Understanding these nuances will enable you to select a policy appropriate for your particular vehicle and level of personal risk tolerance.

Your driving habits are also quite important. While some drivers might choose less protection, regular long-distance driving can demand more thorough coverage. Examining your regular travel patterns and consumption can allow you to find the perfect degree of coverage that satisfies your needs without exceeding.

Mostly, the process of making decisions centers on financial concerns. Making a budget for your auto insurance will allow you to limit the options. One should understand policies limits and deductibles in addition to the premiums. Reviewing the terms is absolutely necessary since a policy with lowered rates can have less coverage or greater deductibles. By considering savings offered by several insurance companies, including safe driving prizes or multi-policy discounts, a savvy financial decision can also be beneficial.

At last, one should review quotes from numerous companies. Use internet resources or consult insurance brokers to get various estimates and ensure you make a well-informed decision fit for your demand.

Strategies to Save on Auto Insurance in 2025

Since auto insurance rates keep rising, drivers in 2025 have to find effective strategies to lower rates. One of the key ways to cut insurance expenses is by applying the many discounts offered by insurance companies. A safe driver discount is an incentive for those with a clean driving record free of accidents and violations. Good drivers could drastically lower their premium prices for policyholders.

Another quite effective approach to save money is grouping insurance plans. Many businesses provide savings to consumers who combine auto insurance with other types of coverage, such renters’ or homeowners’ insurance. Apart from simplifying premium payments, this connection enhances client loyalty, hence increasing the financial benefits. Therefore, considering options for combination insurance might lead to fairly large savings.

Maintaining a decent credit score is also very crucial in determining vehicle insurance costs. Insurance firms view higher credit score consumers as lower-risk clients, which results in reduced premiums. Therefore, over time, implementing sound financial policies can help to lower insurance prices. Frequent review of one’s credit record and correction of any discrepancies will help to increase credit score, thereby saving a lot of vehicle insurance.

New developments in the field such use-based insurance and telematics are beginning to take root. Telematics is the arrangement of technologies monitoring driving behavior including mileage, braking patterns, and speed. Insurance companies might offer drivers who exhibit good driving behavior discounts using this technology. Use-based insurance is also a wonderful option for individuals who drive less regularly since premiums rely on the actual mileage driven. By 2025 drivers who embrace these innovative ideas will optimize their vehicle insurance savings.

Future Trends and Changes in Auto Insurance

Driven by improvements in technology, changing legal frameworks, and shifting customer tastes, the scene of auto insurance in the USA is probably going to change greatly as we look ahead to 2025. One of the most visible trends since they could affect not only our road-travel but also insurance premiums is the development of driverless cars. Liability concerns will most likely shift when self-driving cars find increasing availability on the market. Coverage and policy forms may be changed if insurers had to assess the risks associated with manufacturers of these vehicles instead of regular drivers, therefore influencing decisions.

Moreover becoming very prevalent is telematics technology, which makes use of gadgets monitoring driving behavior. Depending on specific driving behavior, this technology allows businesses to offer more tailored prices. Since customers are becoming more data-savvy and this pay-as-you-drive model promotes safer driving while maybe saving costs for conscientious drivers, it is predicted to become more popular. Including artificial intelligence into underwriting processes will also help to improve risk assessment, so enhancing premium pricing accuracy and speedy claim resolution accuracy.

Also changing is the scenario of rules concerning motor insurance. New technologies challenge authorities in developing mechanisms that assure consumer protection while fostering innovation by means of guarantees. This could alter the dynamics of the industry by creating new insurance needs notably for electric and driverless cars. Moreover, consumer preferences toward insurers offering environmentally friendly plans and incentives for owners of electric cars might shift as public knowledge of sustainability rises.

In conclusion, the future of auto insurance in the USA is poised for significant changes by 2025, driven by technological advancements, shifts in regulations, and a change in consumer behavior. As these trends unfold, drivers will need to stay informed about their insurance options to navigate this evolving landscape effectively.